What is Good Advice from a Wealth Manager? Part 1

Investing should be just a small part of the conversation

By Robert J. Pyle, CFP®, CFA

Key Takeaways

All kinds of people claim to be wealth advisors--research show only out of 16 really are.

Does your advisor have the ability to see your entire financial picture and how your values, goals and people close to you fit into that picture?

A wealth manager should be a personal CFO/financial consigliere who always has your best interests in mind.

Before committing to working with an advisor, be 100-percent clear how they get paid.

In today’s climate of one-page financial plans, bargain-basement fund pricing and automated investment tools, you may wonder if it’s still necessary to have a human financial adviser. If you’re like most successful people, it is. As an accomplished business owner, professional or retiree, you financial life is too complex to be robo-cized and investments are just a small part of your overall picture.

It goes without saying that you want an advisor who is a true fiduciary; someone who always has your best interests in mind. You want someone who is not under pressure to earn commissions and who is free to recommend the very best products and solutions that meet your needs—not simply the ones that his or her employer is pushing at the moment.

All kinds of people can call themselves wealth advisors these days, but you’ll probably find that advisors with CFP®, CFA or CPA after their names. Those credentials aren’t just professional “vanity plates.” They’re not easy to obtain and require a level of skill, training, independence and fiduciary responsibility that a stock picker, investment consultant or algorithm isn’t required to have.

Also make sure you understand how your advisor is paid. True wealth advisors are paid on a fee-only model, rather than a commission model. In other words, they earn a fixed percentage of your assets under their management and do not get paid a commission each time you make a trade. If they help you grow your wealth then they earn more along with you. If your wealth declines under their guidance, then they earn less. Compare that to a commission based advisor (human or machine) that gets paid whenever you buy or sell an asset, regardless of whether that investment worked out for you.

Commission-based advisors are still capable of making smart investment recommendations, but they don’t have a specific investment philosophy or for each client they serve. They frequently change philosophies when new ones come out each week from the “people upstairs.”

Whether human or machine, advice providers at the major financial institutions don’t normally spend time educating their clients about their philosophy or provide them with unique ideas to help them build their wealth. Their business model generally doesn’t allow them to invest the time in doing what’s in the very best interests of each client—they just need to make sure their recommendations are “suitable.”

As Nobel Laureate Eugene Fama once observed: “Academic research produces about three to five good ideas every 20 years. However, the financial industry packages and sells about 10 new ideas per week.” Note the emphasis on “new” rather than “good.

Wealth Managers/Trusted Advisors using the fee-only model

By contrast, wealth managers use a disciplined process to interview a prospective client and are more selective about who they take on. The client is always at the top of the model and wealth managers determine the best solutions for each client using an in-depth method that I’ll share with you shortly. Of course that takes a special type of skill, independence and expertise. Research from CEG Worldwide shows that only one out of every 16 financial professionals (6.6%) are truly consultative wealth manager

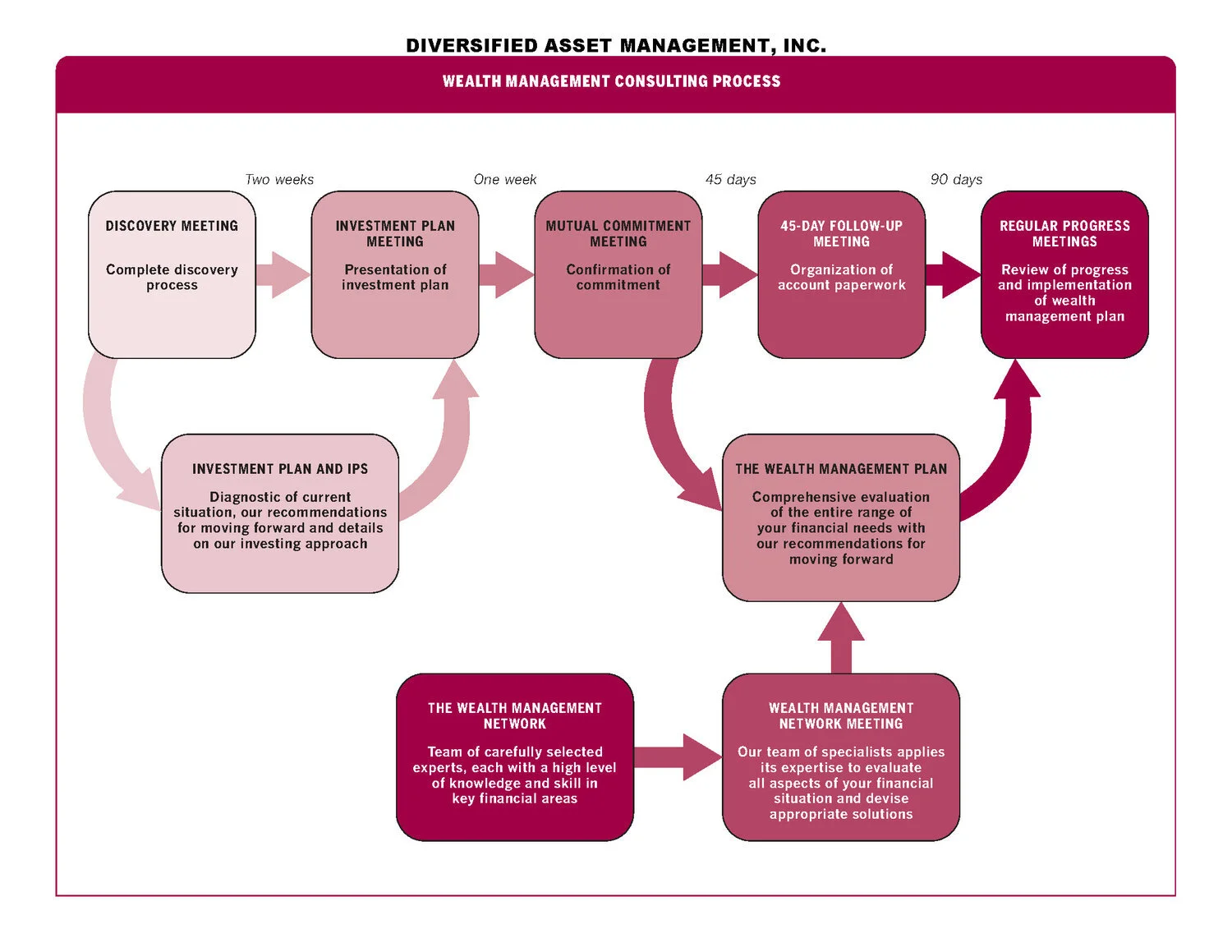

If you’re still not sure how a wealth manager works with clients, let’s take a closer look that the process they follow. Here’s how it works at our firm:

1. Discovery Meeting. At this initial meeting with a prospective client, a wealth advisor asks detailed questions to find out what is important to the prospective client in terms of values, goals, relationships, assets, advisors, interests and—very important—the extent to which they want to be involved in the process. Some clients want to be very hands on and others want to be hands-off. No two client situations are the same and a truly consultative wealth advisor can tailor his or her approach to each unique client preference.

2. Investment Plan (IP). The next step is to take the information from the Discovery Meeting, analyze it and craft an IP. The investment plan looks at where the prospective client is today in their personal and financial life, where they want to be ideally and what the gaps are between they are now and where they want to go. A truly consultative wealth advisor presents the investment plan at the Investment Plan Meeting and offers solutions to close that gap—solutions they are equipped to implement.

3. Mutual Commitment Meeting. If the prospective client is satisfied with the IP, then we move toward a meeting at which we mutually agree to work together. This is when the prospective client signs the paperwork to become a bona fide client.

4. The 45-Day Follow-up Meeting occurs about 1-1/2 months after the client has been on-boarded. At this very important check-in meeting, the trusted advisor reviews all the paperwork that a client has received and updates the client on the progress the firm has made toward the clients goals so far.

5. Regular Progress Meetings occur at a frequency with which the client is most comfortable. Some clients only want to meet for an annual or semi-annual checkup. Others prefer more frequent contact, often to bounce ideas off their trusted advisors—they don’t necessarily have to meet only when there is a crisis or major change in life circumstances. The trusted advisor and client review the progress and implementation of the wealth management plan and make mid-course corrections as needed. The meetings are generally built into the advisor’s annual management fee, so clients don’t feel like the “advice meter” is always ticking.

In addition to the five steps above, true wealth managers create a financial plan and an advanced plan that includes a comprehensive evaluation of the client’s entire range of financial needs and recommendations for going forward. The financial plan typically looks at where clients are now and what each one needs to do in order to retire on their own terms. The advanced plan focuses on wealth management items such as maximizing wealth, protecting wealth and tax-advantaged ways to give some of their wealth away to deserving heirs and causes.

If nothing else, your wealth manager should be your personal CFO/financial consigliere—a trusted advisor who functions as the noise cancelling headphones in your life. He or she should be someone who can help you filter out the noise of dramatic market swings and screaming headlines from the news media and the internet. A wealth advisor understands that your ultimate goal is not to make more money in the market; it’s to get to your destination in the most relaxed manner as possible and enable you to enjoy the life that your money intended you to live.

Conclusion

Advice is cheap. Good advice is worth its weight in gold. In Part 2 of this post we’ll look at what constitutes good advice from wealth advisors who are truly fiduciaries. If you or someone close to you is not sure about where to turn for financial advice, please consider scheduling a complimentary second opinion discovery call.

Robert J. Pyle, CFP®, CFA is president of Diversified Asset Management, Inc. (DAMI). DAMI is licensed as an investment adviser with the State of Colorado Division of Securities, and its investment advisory representatives are licensed by the State of Colorado. DAMI will only transact business in other states to the extent DAMI has made the requisite notice filings or obtained the necessary licensing in such state. No follow up or individualized responses to persons in other jurisdictions that involve either rendering or attempting to render personalized investment advice for compensation will be made absent compliance with applicable legal requirements, or an applicable exemption or exclusion. It does not constitute investment or tax advice. To contact Robert, call 303-440-2906 or e-mail info@diversifiedassetmanagement.com.

The views, opinion, information and content provided here are solely those of the respective authors, and may not represent the views or opinions of Diversified Asset Management, Inc. The selection of any posts or articles should not be regarded as an explicit or implicit endorsement or recommendation of any such posts or articles, or services provided or referenced and statements made by the authors of such posts or articles. Diversified Asset Management, Inc. cannot guarantee the accuracy or currency of any such third party information or content, and does not undertake to verify or update such information or content. Any such information or other content should not be construed as investment, legal, accounting or tax advice.

Tagged: Financial Advisor, secure information, investment news, behavioral finance

0 Likes Share